NEW VERSION OF THE COMBINED NOMENCLATURE APPLICABLE AS FROM 1 JANUARY 2023

The European Commission has published the new version of the Combined Nomenclature (new customs codes) applicable as from 1 January 2023.

The new version is now available as Commission Implementing Regulation (EU) N 2022 /1998 of 20 September 2022 and published in the Official Journal of the European Union N L 282 of 31 October 2022.

The concerned Official Journal N 282 is available on https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L:2022:282:FULL&from=EN

The new version applies from 1 January 2023.

OPTIONAL VAT REVERSE CHARGE MECHANISM IN PLACE UNTIL 2027

On 3 June 2022, the finance ministers of the EU Member States adopted a Directive amending EU VAT legislation to extend the application period of the optional VAT reverse charge mechanism until 31 December 2026.

It concerns the Directive (EU) 2022/890 of 3 June 2022 amending Directive 2006/112/EC as regards the extension of the application period of the optional reverse charge mechanism in relation to supplies of certain goods and services susceptible to fraud and of the Quick Reaction Mechansism against VAT fraud (in attachment).

The reverse charge mechanism is a measure that aims to reduce the risk of VAT fraud, and particularly missing Trader Intra-Community fraud, by shifting liability for VAT from the vendor to the customer.

This type of fraud occurs when a trader acquires goods, transported or dispatched from another EU Member State, and exempt from VAT, and sells them on including VAT on the invoice to the customer.

After having received the VAT amount from the customer, the trader disappears before paying the VAT due to the tax authorities.

The extension will also apply to the Quick Reaction Mechanism (QRM) to combat VAT fraud.

The QRM allows EU Member States to quickly introduce a temporary reverse charge mechanism for the supply of goods and services in particular sectors if sudden, massive fraud occurs.

PUBLICATION BY EUROPEAN COMMISSION OF UPDATED OVERVIEW OF FREE TRADE AGREEMENTS AND OTHER TRADE NEGOTIATIONS

The European Commission has published end of February 2022 an updated overview of Free Trade Agreements and other Trade negotiations.

The attached list can be found here (in EN)

More information is available here https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/negotiations-and-agreements_en

PUBLICATION OF THE NEW VERSION OF THE COMBINED NOMENCLATURE APPLICABLE AS FROM 1 JANUARY 2022

The European Commission has published the new version of the Combined Nomenclature (new customs codes) applicable as from 1 January 2022.

The Combined Nomenclature (CN):

- forms the basis for the declaration of goods at importation and exportation or when subject to intra-Community trade statistics.

- determines which rate of customs duty applies for goods imported in the European Union and how the goods are treated for statistical purposes.

The Combined Nomenclature was established by Council Regulation (EEC) Nr 2658/87 on the tariff and statistical nomenclature and on the Common Customs Tariff.

The Combined Nomenclature is thus a vital working tool for business and is updated every year.

The new version is now available as Commission Implementing Regulation (EU) Nr 2021/1832 of 12 October 2021 and published in the Official Journal of the European Union Nr L 385 of 29 October 2021.

The concerned Offical Journal Nr L 385 is available via the European website EUR-LEX on http://eur-lex.europa.eu

The new version applies from 1 January 2022.

NEW UPDATED LIST OF PROTOCOLS ON PREFERENTIAL ORIGIN AND CUSTOMS UNION -VERSION SEPTEMBER 2021

Please find enclosed the new updated List of protocols on Preferential Origin and Customs Unions published by the Belgian Customs Administration (currently only available in Dutch and French language).

The attached list provide an overview of the:

* Preferential Origin Protocols for the Pan-Euro-Mediterranean countries, the Western Balkan countries and other countries/territories and,

* Autonomous Preferential Arrangements for the Overseas Countries and Territories and for the non-developped countries (Generalised System of Preferences).

* Customs Unions.

Per Preferential Origin Protocol and per Preferential Arrangement that is included in the list, details are mentioned concerning the:

-proof of origin (certificate of origin or invoice declaration).

- delay of validity of the proof or origin.

- cumulation of origin .

- subsequent verification of proofs of origin.

- proof or origin for consignments by mail.

- exemptions from proofs of origin.

- legal basis Origin Protocol / Preferential Arrangement .

The attached list can be found here (in NL) (in FR)

UPDATE RULES OF NON-PREFERENTIAL (ECONOMIC) ORIGIN

The European Commission (Directorate General Taxation and Customs Union – DG TAXUD) has published the updated 'list rules' of non-preferential (economic ) origin as support for businesses and customs authorities.

The concerned 'list rules' apply to products following the classification in the Combined Nomenclature (CN).

All information in this respect is available on-line on:https://ec.europa.eu/taxation_customs/business/calculation-customs-duties/rules-origin/nonpreferential-origin/table-list-rules-applicable-products-following-classification-cn_en

ENTRY INTO FORCE OF NEW VAT RULES FOR E-COMMERCE

The new VAT rules for e-commerce will be rolled out across the European Union from 1st July to simplify life for businesses that sell goods online, while ensuring a more level playing field with online companies from outside the European Union.

These rules will be particularly significant for anyone selling goods online or running an online marketplace.

The aim is:

* ensure that VAT is paid where goods are consumed or the services paid for are provided;

* create a uniform VAT regime for cross-border supplies of goods and services;

* offer businesses a simple system to declare and pay their VAT in the European Union, using the (Import) One-Stop Shop portal;

* introduce a level playing field between EU businesses and non-EU sellers.

BENEFITS OF BUSINESSES FROM THE NEW RULES

The European Union has developed new online tools where businesses can register and take care of their VAT obligations for all their sales in the EU. This replaces the previous system whereby online companies were obliged to register for VAT in each country before they could sell to consumers there.

As of 1 July, businesses will be able to electronically declare and pay the VAT for all their intra-EU sales in a single quarterly return – all while working with the tax administration of their own Member State and in their own language, even when their sales are cross-border.

The new platform for businesses and taxable persons, the VAT One-Stop Shop (OSS), can be used to account for the VAT due on goods and services sold online throughout the European Union, reducing compliances costs by up to 95%.

Meanwhile, the Import One-Stop Shop (IOSS) facilitates the collection, declaration and payment of VAT for sellers that are supplying goods from outside the EU to customers in the EU.

In practice, this means that these suppliers and electronic interfaces can collect, declare and directly pay the VAT to the tax authorities of their choice, rather than having the customer pay the import VAT at the time the goods are delivered to him.

This makes life easier for the businesses, but also protects online shoppers from hidden costs.

Finally, the current VAT exemption for packages entering the European Union with a value not exceeding 22 Eur will be abolished. While most non-EU company play fair, this exemption however meant that some sellers were able to fraudulently declare high-cost goods, such as smartphones, at a lower price only to benefit of this exemption, thus undercutting EU companies who had no choice but to charge their EU customers the full VAT rate on the same products.

By eliminating this exemption, EU businesses will be able to compete within the level playing-field.

More information is available on https://ec.europa.eu/vat-ecommerce

EVALUATION COMPREHENSIVE ECONOMIC AND TRADE AGREEMENT BETWEEN EU AND CANADA

Last week of March 2021 during the second Joint Committee meeting the European Union and Canada highlighted the positive impact of the Comprehensive Economic and Trade Agreement (CETA) in helping to minimise the economic impact of COVID-19.

This agreement is a central pillar of the trade and economic partnership between the EU and Canada. Canada is an important partner to address global challenges such as economic recovery, World Trade Organization reform, investment reform, trade and so on.

CETA is a recent trade agreement but it has already delivered very positive results.

EU-Canada trade had increased by 25% compared to pre-CETA figures, until the start of the pandemic. Even when taking into account the impact of COVID-19 on international trade, EU-Canada trade flows were still 15% higher in 2020 than before CETA’s provisional entry into force.

CETA is also helping to improve regulatory cooperation and a commitment to facilitate cross-border flows of services with a focus on the mutual recognition of professional qualifications.

There are other positive developments achieved under CETA, including the implementation of the Trade and Sustainable Development chapters.

Furthermore there is important progress towards developing a new Canada-EU Strategic Partnership on Raw Materials intended to reduce supply chains risks and foster competitive Canada-EU value chains that depend on minerals and metals raw material inputs.

Both parties agreed also to intensify efforts to ensure that all companies are able to take full advantage of the opportunities offered by CETA.

The next meeting of the CETA Joint Committee will be held in Canada in 2022.

For more information concerning the Comprehensive Economic and Trade Agreement between the EU and Canada, please see on: https://ec.europa.eu/trade/policy/in-focus/ceta

PUBLICATION BY EUROPEAN COMMISSION OF NOTICE REGARDING WITHDRAWAL OF UK AND EU RULES IN THE FIELD OF CUSTOMS INCLUDING PREFERENTIAL ORIGIN IN CONTEXT OF BREXIT

The notice (update of 23 December 2020) regarding withdrawal of the United Kingdom and EU rules in the field of Customs including Preferential Origin in context of Brexit has been published by the European Commission.

The relationship from 1 January 2021 between EU 27 and UK is, in terms of market access conditions, totally different from the UK participation in the internal market before the 1st of January 2021, in the EU Customs Union, and in the VAT and excise duty area.

This notice (in attachment) explains:

- the legal situation applicable after the end of the transition period on 31 December 2020 (Part A of the notice) including seperation provisions of the Withdrawal Agreement.

With respect to the recent EU Regulation of 29 December 2020 on the making out of statements on origin for preferential exports to see the newsletter in attachment and the regulations here

PUBLICATION OF EU REGULATION REGARDNG PROVISIONAL APPLICATION OF THE TRADE AND COOPERATION AGREEMENT BETWEEN EU AND UK

On 29 December 2020:

- the Council Decision (EU) 2020/2252 of 29 December 2020 on the signing, on behalf of the Union, and on provisional application of the Trade and Cooperation Agreement between the EU and UK, and of the Agreement between the EU and the UK and Northern Ireland concerning security procedures for exchanging and protecting classified information and,

- the text of the aforementioned agreements,

have been published in the Official Journal of the European Union Nr L 444 of 31 December 2020.

For more information in this respect, please consult the text of the aforementioned EU Regulation and agreements (O.J.L 44 ) on http://eur-lex.europa.eu

notice (press release) published by the European Commission (in attachment)

NEXT STEPS

The European Parliament will now be asked to give its consent to the Agreement.

As a last step on the EU side, the EU Council must adopt the decision on the Conclusion of the Agreement.

OVERVIEW OF CONSEQUENCES AND BENEFITS OF EU- UK TRADE AND COOPERATION AGREEMENT APPLICABLE AS FROM 1 JANUARY 2021

On 24 December 2020, the EU and UK negotiators reached an 'agreement in principle' on the text of a new 'Trade and Cooperation Agreement' to govern their future relations.

The draft Trade and Cooperation Agreement consists of three main pillars:

A FREE TRADE AGREEMENT: a new economic and social partnership with the United Kingdom

-The agreement covers not just trade in goods and services, bit also a broad range of other areas in the EU's interest, such as investment, competition, State aid, tax transparency, air and road transport, energy, fisheries, data protection, and social security coordination.

-It provides for zero tariffs and zero quotas on all goods that comply with the appropriate rules of origin.

-Both parties have committed to ensuring a level playing field by maintaining high levels of protection in areas such as environmental protectio, the fight against climate change and carbon pricing, social and labour rights, tax transparency and State aid, with effective, domestic enforcement and a binding dispute settlement mechanism.

-The EU and the UK agreed on a new framework for the joint management of fish stocks in EU and UK waters. The UK will be able to further develop British fishing activities, while the activities of European fishing communities will be safeguarded and natural resources preserved.

-On transport, the agreement provides for continued air, road, rail and maritime connectivity, through market access fails below what the Single Market offers.

-On energy, the agreement provides a new model for trading and interconnectivity, with guarantees for open and fair competition, including on safety standards for offshore, and production of renewable energy.

-On social security coordination, the agreement aims at ensuring a number of rights of EU citizens and to UK nationals. This concerns EU citizens working in, traveling or moving to the UK and to UK nationals working in, travelling or moving to the EU after the 1st January 2021.

-Finally, the agreement enables the UK's continued participation in a number of flagship EU programmes for the period 2021-2027 (subject to a financial contribution by the UK to the EU budget), such as Horizon Europe.

A NEW PARTNERSHIP FOR CITIZENS SECURITY

-The Agreement establishes a new framework for law enforcement and judicial cooperation in criminal and civil law matters.

It recognises the need for strong cooperation between national police and judicial authorities, in particular for fighting and prosecuting cross-border crime and terrorism.

It builds new operational capabilities, taking account of the fact that the UK, as a non-EU member outside to the Schengen area, will not have the same facilities as before.

A HORIZONTAL AGREEMENT ON GOVERNANCE

-To give maximum legal certainty to businesses, consumers and citizens, a dedicated chapter on governance provides clarity on how the agreement will be operated and controlled.

It also establishes a Joint Partnership Council, who will make sure the Agreement is properly applied and interpreted, and in which all arising issues will be discussed.

-Binding enforcement and dispute settlement mechanisms will ensure that rights of businesses are respected. This means that businesses in the EU and the UK compete on a level playing field and will avoid either party using its regulatory autonomy to grant unfair subsidies or distort competition.

-Both parties can engage in cross-sector retaliation in case of violations of the agreement. This cross-sector retaliation applies to all areas of the economic partnership.

NEXT STEPS

The entry into application of the Agreement is a matter of special urgency.

The UK has extensive links with the Union in a wide range of economic and other areas. If there is no applicable framework regulating the relations between the Union and the UK after 31 December 2020, those relations will be disrupted, to the detriment of businesses and individuals. The negotiations could only be finalized at a very late stage before the expiry of the transition period. Such late timing should not jeopardise the European Parliament's right of democratic scrutiny.

In the given circumstances the European Commission proposes to apply the Agreement on a provisional basis, for a limited period of time until 28 February 2021.

The European Commission will swiftly propose EU Council decisions on the signature and provisional application, and on the conclusion of the Agreement.

The Council, acting of all 27 Member States, will then need to adopt a decision authorising the signature of the Agreement and its provisional application as of 1 January 2021.

Once this process is concluded, the Agreement between the EU and UK can be formally signed and the European Parliament will then be asked to give its consent to the Agreement.

As a last step on the EU side, the EU Council must adopt the decision on the conclusion of the Agreement.

For more information in this respect, please consult the document 'Questions & Answers : EU - UK Trade and Cooperation' on https://ec.europa.eu/commission/presscorner/detail/en/qanda_20_2532

PUBLICATION OF THE NEW VERSION OF THE COMBINED NOMENCLATURE APPLICABLE AS FROM 1 JANUARY 2021

The European Commission has published the new version of the Combined Nomenclature (CN) applicable as from 1 January 2021.

The Combined Nomenclature (CN):

- forms the basis for the declaration of goods at importation and exportation or when subject to intra-Community trade statistics.

- determines which rate of customs duty applies for goods imported in the European Union and how the goods are treated for statistical purposes.

The Combined Nomenclature is thus a vital working tool for business and is updated every year.

The new version is now available as Commission Implementing Regulation (EU) Nr 2020 /1577 of 21 September 2020 amending Annex I to Council Regulation (EEC) 2658/87 on the Tariff and Statistical Nomenclature and on the Customs Tariff published in the Official Journal of the European Union Nr L 361 of 30 October 2020.

The concerned Offical Journal Nr L 361 is available via the European website EUR-LEX on http://eur-lex.europa.eu

BREXIT - PUBLICATION BY UK AUTHORITIES OF DIRECTIVES FOR FUTURE TRADE BETWEEN EU AND UK AS FROM 1 JANUARY 2021

On 15 October 2020 the authorities from the United Kingdom have published updated Directives for the future trade between the European Union and the United Kingdom applicable as from 1 January 2021.

The information in this respect is available on: https://www.gov.uk/transition

Agendas for the next rounds of the Brexit negotiations between the EU and UK and workingdocuments will be published by the European Commission online in due course on:

https://ec.europa.eu/info/brexit_en

More information on Brexit published by Belgian Customs Administration is available on: https://finance.belgium.be/en/customs_excises/enterprises/brexit/more-info/external-sources

REMARKS BY EUROPEAN COMMISSIONER MICHEL BARNIER FOLLOWING ROUND 7 OF THE NEGOTIATIONS FOR NEW PARTNERSHIP BETWEEN THE EUROPEAN UNION AND THE UNITED KINGDOM

On 24 August 2020 European Commissioner Michel Barnier with EU experts continued the discussions with the UK negotiators during round 7 of negotiations for a new partnership between the European Union and the United Kingdom.

The discussions enabled the European Union to clarify a number of issues in areas such as trade in goods, guarantees for a level playing field -including on state aid, a balanced agreement on fisheries, an overarching institutional framework and dispute settlement mechanisms.

The proper and timely implementation of the Withdrawal Agreement (in attachment) remains a key priority for the European Union.

For more information in this respect, please see the remarks by European Commissioner Michel Barnier.

Agendas for the next rounds of the negotiations between the EU and UK and workingdocuments will be published by the Eurpean Commission online in due course on: https://ec.europa.eu/info/brexit_en

SPEECH OF 17 JUNE 2020 BY THE PRESIDENT OF THE EUROPEAN COMMISSION AT THE EUROPEAN PARLIAMENT ON THE NEGOTIATIONS FOR A NEW PARTNERSHIP WITH THE UNITED KINGDOM

On 17 June 2020 President van der Leyen from the European Commission has held a speech in attachment at the European Parliament Plenary on the negotiations for a new partnership with the United Kingdom.

Recently the Prime Minister of the United Kingdom confirmed that he does not want to extend the transition period beyond the end of this year.

The proper and timely implementation of the Withdrawal Agreement remains a key priority for the European Union.

More information concerning the current status of the negotiations, the agendas for the next rounds of the negotiations between the EU and UK and the workingdocuments are available on: https://ec.europa.eu/info/brexit_en

PUBLICATION EU COUNCIL DECISION AUTHORISING THE OPENING OF NEGOTIATIONS WITH UNITED KINGDOM FOR NEW PARTNERSHIP AGREEMENT

Please find enclosed the Council Decision (EU, Euratom) 2020/266 of 25 February 2020 authorising the opening of negotiations with the United Kingdom of Great Britain and Nothern Ireland for a new partnership agreement.

Conform this Council Decision ( article 2) the European Commission is nominated as EU negotiator and the negotiations shall be conducted in consultation with the Working Party on the United Kingdom.

BACKGROUND

On 1 February 2020 the United Kingdom withdrew from the European Union.

The arrangements for the withdrawal are set out in the Withdrawal Agreement (published in the Official Journal of the EU, Nr L 29 of 31 January 2020).

The Withdrawal Agreement entered into Force on 1 February 2020 and provides for a transition period during which Union law applies to and in the UK.

That period will end on 31 December 2020, unless the joint Committee established by the Withdrawal Agreement adopts before 1 July 2020, a decision extending the transition period for up to 1 or 2 years.

The Political Declaration (Published in the Official Journal of the EU, Nr C 34 of 31 January 2020) that accompanied the Withdrawal Agreement sets out the framework for the future relationship between the EU and the UK.

In this context negotiations will be opened with a view to concluding a new partnership agreement with the UK.

CONSEQUENCES WITHDRAWAL OF UNITED KINGDOM FROM THE EUROPEAN UNION

On 31 January 2020 at midnight (00:00 CET) the United Kingdom left the European Union.

This follows the ratification of the Withdrawal Agreement last week by both the European Parliament and the EU Council.

The Withdrawal Agreement provides for a transition period until at least 31 December 2020, during which the UK remains a Member of the Single Market and the Customs Union.

On 3 February 2020, the European Commission will adopt and present draft negotiating directives for the future relationship negotiations with the United Kingdom to the EU Council.

For more information on the Witdrawal Agreement, please see the publication in this respect of the European Commission.

PUBLICATION OF EU COUNCIL DECISION ON THE SIGNING OF THE AGREEMENT ON THE WITHDRAWAL OF THE UNITED KINGDOM FROM THE EUROPEAN UNION

The Council Decision (EU) 2020 /48 of 21 January 2020 (see attachment), amending Decision (EU) 2019/274 (OJ L47 of 19 february 2019) on the signing, on behalf of the European Union and of the Agreement on the withdrawal of the United Kingdom of Great Britain and Nothern Ireland from the European Union (Published in the Official Journal of the European Union Nr L 16 of 21 January 2020).

BACKGROUND

On 11 January 2019, the Council adopted Decision (EU) 2019/274 (OJ L 47 of 19 February 2019) on the signing of the Withdrawal Agreement.

The adapted version of the Withdrawal Agreement (see attachment) was published in the Official Journal of the European Union Nr C 384 of 12 November 2019).

The third paragraph of Article 185 of the Withdrawal Agreement provides that when making the written notification of the completion of its necessary internal procedures, the European Union may declare that during the transition period (until 31 December 2020) the executing judicial authorities of a Member State may refuse to surrender its nationals to the UK pursuant to a European Arrest Warrant . Those Member Statest that intend to avail themselves of the possibility provided for in the Withdrawal Agreement are to inform the European Commission of their intention to do so before 15 February 2019.

Given the various extensions of the transition period it is appropriate to amend the a new time limit within which Member States that intend to avail themselves of the possibility provided for in the Withdrawal Agreement should inform the European Authorities.

The Decision (EU) 2019/274 must therefore be amended accordingly.

NEW CUSTOMS CODES APPLICABLE AS FROM 1 JANUARY 2020

PUBLICATION OF CORRELATION TABLE RELATED TO 2020 COMBINED NOMENCLATURE

With the newsletter of the Customs Platform 5 November 2019 the Members of the Customs Platform have been informed about the publication by the European Commission of the latest version of the Combined Nomenclature (Regulation EU Nr 2019/1776 of 9 October 2019) applicable as from 1 January 2020 and published in the Official Journal of the European Union of 31 October 2019, Nr L280.

In this respect please find enclosed the "CORRELATION TABLE" for the conversion of the current customs codes to the new customs codes applicable from 1 January 2020.

For more information, please see in attachment

PUBLICATION OF THE NEW VERSION OF THE COMBINED NOMENCLATURE APPLICABLE AS FROM 1 JANUARY 2020

The European Commission has published the new version of the Combined Nomenclature (CN) applicable as from 1 January 2020.

The Combined Nomenclature (CN) : - forms the basis for the declaration of goods at importation and exportation or when subject to intra-Community trade statistics. - determines which rate of customs duty applies for goods imported in the European Union and how the goods are treated for statistical purposes.

The Combined Nomenclature is thus a vital working tool for business and is updated every year.

The new version is now available as Commission Implementing Regulation (EU) Nr 2019 / 1776 of 9 October 2019 published in the Official Journal of the European Union Nr L 280 of 31 October 2019.

The concerned Offical Journal Nr L 282 is available via the European website EUR-LEX on http://eur-lex.europa.eu

BREXIT -EUROPEAN COMMISSION RECOMMENDS EUROPEAN COUNCIL TO ENDORSE THE AGREEMENT REACHED ON THE REVISED PROTOCOL ON IRELAND/NORTHERN IRELAND AND REVISED POLITICAL DECLARATION

The European Commission has yesterday 17 October 2019 recommended the European Council (Article 50) to endorse the agreement reached at negotiator level on the Witdrawal Agreement reached on 14 November 2018

This follows a series of intensive negotiations between the European Commission and UK negotiators over the past few days.

The revised Protocol provides a legally operational solution that avoids a hard border on the island of Ireland, protects the all- island economy and the Good Friday (Belfast) Agreement in all its dimensions and safeguards the integrity of the Single Market.

All other elements of the Withdrawal Agreement

( see attachment) remain unchanged, as per the agreement reached on 14 November 2018.

The Withdrawal Agreement brings legal certainty where the UK's withdrawal from the EU created uncertainty: citizens rights, the financial settlement, a transition period at least until the end of 2020.

CONSEQUENCES OF THE REVISED WITHDRAWAL AGREEMENT

In terms of regulations, Northern Ireland will remain aligned to a limited set of rules related to the EU's Single Market in order to avoid a hard border: legislation on goods, sanitary rules for veterinary controls, rules on Agricultural production /marketing, VAT and excise in respect of goods, and state aid rules.

In terms of customs, the EU –UK Single Customs Territory, as agreed with the withdrawal agreement on 14 November 2018, has been removed from the Protocol on Ireland/ Northern Ireland, at the request of the current UK government.

EU and UK negotiators have now found a new way to achieve the goal of avoiding a customs border on the island of Ireland, while at the same time ensuring Northern Ireland remains part of the UK's customs territory.

This agreement fully protects the integrity of the EU's Single Market and Customs Union, and avoids any regulatory and customs checks at the border between Ireland and Northern Ireland.

THE REVISED POLITICAL DECLARATION

The main change in the Political Declaration relates to the future EU-UK economic relationship where the current UK government has opted for a model based on aFree Trade Agreement (FTA ).

The Political Declaration provides for an Free Trade Agreement with zero tariffs and quotas between the EU and the UK. It states that robust commitments on a level playing field should ensure open and fair competition.

NEXT STEPS

It's now for the European Council to endorse the revised Withdrawal Agreement in its entirely, as well as approve the revised Political Declaration on the framework of the future relationship.

Before the Withdrawal Agreement can enter intoforce, it needs to be ratified by the European Union and the United Kingdom.

For the European Union, the Council of the European Union must authorise the signature of the Withdrawal Agreement, before sending it to the European Parliament for its consent.

The Parliament of the United Kingdom must now ratify the Withdrawal Agreement according to its own constitutional arrangements. There is a meeting planned of the UK Parliament for this week on Saturday 19 October 2019.

For more information, please see in attachment the:

-Fact Sheet publised by the European Commission with Questions and Answers.

BREXIT 'NO DEAL' PREPAREDNESS , FINAL COMMISSION CALL TO EU BUSINESSES TO PREPARE FOR UK 'S WITHDRAWAL ON 31 OCTOBER 2019

The European Commission has last week 4th September 2019 – in its 6th Brexit preparedness Communication (see attachment) – reiterated its call on all stakeholders in the EU 27 to prepare for a 'no-deal' scenario. In light of the continued uncertainty in the UK regarding the ratification of the Withdrawal Agreement – as agreed with the UK government in November 2018.

It is in this spirit that the European Commission has last week published a detailed checklist to help those businesses that trade with the UK to make final preparations. In order to minimize disruption to trade, all parties involved in supply chains with the UK –regardless of where they are based – should be aware of their responsibilities and the necessary formalities in cross-border trade.

In addition to this, the European Commission has proposed to the European Parliament and the Council to make targeted technical adjustments to the duration of the EU's 'no-deal' contingency measures in the area of transport. The European commission has also proposed to mirror, for the year 2020, the existing 2019 contingency arrangements for the fisheries sector and for the UK's potential participation in the EU budget for 2020.

These measures are necessary given the decision to extend the Article 50 period to 31 October 2019.

Finally, the European Commission has proposed that the European Solidarity Fund and the European Globalisation Adjustment Fund are available to support businesses, workers and Member states most affected by a 'no-deal' scenario.

These proposals need to be agreed by the European Parliament and the Council.

TECHNICAL ADJUSTMENT OF SPECIFIC CONTINGENCY MEASURES TO TAKE ACCOUNT OF THE UK'S WITHDRAWAL DATE OF 31 OCTOBER 2019

These adjustments are in three main areas:

1. TRANSPORT

- A Regulation ensuring basic road freight and road passenger connectivity (Regulation (EU) 2019/501 ): the European Commission has last week proposed to extend this Regulation until 31 July 2020, reflecting the logic and the duration of the original Regulation.

- Basic air connectivity (Regulation (EU) 2019/502): the European Commission has today proposed to extend this Regulation until 24 October 2020, reflecting the logic and duration of the original Regulation.

2. Fishing activities

- Regulation on fishing authorisations: the European Commission has today proposed to extend the approach in the adopted contingency Regulation (Regulation (EU) 2019/498) with a similar measure for 2020, providing a framework for EU and UK fishermen to maintain access to each other's waters for 2020.

3. The EU Budget

- The European Commission has last week proposed to extend the approach of the contingency Budget Regulation for 2019 (Council Regulation 2019/1197) with a similar measure for 2020. This means that the UK and UK beneficiaries would remain eligible to participate in programmes under the EU budget and to receive financing until the end of 2020 if the UK accepts and fulfils the conditions already set out in the 2019 contingency Regulation, pays its budget contributions for 2020 and allows the required audits and controls to take place.

IRELAND

The European Commission and Ireland continue working together, in the context of the unique situation on the Island of Ireland and their twin objectives of protecting the integrity of the internal market while avoiding a hard border, to identify arrangements both for contingency solutions for the immediate aftermatch of withdrawal without an agreement and for a more stable solution for the period thereafter.

The backstop provided for by the Withdrawal Agreement is the only solution identified that safeguards the Good Friday Agreement, ensures compliance with international law obligations and preserves the integrity of the internal market.

For more information, please see the:

- 6TH BREXIT PREPAREDNESS COMMUNICATION on : https://ec.europa.eu/info/brexit/brexit-preparedness/other-preparedness-activities_en#communications-of-the-european-commission

-DETAILED CHECKLIST FOR BUSINESSES

EUROPEAN COMMISSION TAKES STOCK OF PREPARATIONS AHEAD OF THE JUNE EUROPEAN COUNCIL

The European has last week 14 JUNE 2019 taken stock – in its fifth Brexit Preparedness Communication – of the European Union's Brexit preparedness and contingency measures (see attachment

see here ) , particularly in light of the decision taken on 11 April by the European Council (Article 50), at the request of and in agreement with the United Kingdom , to extend the Articel 50 period to 31 October 2019.

In light of the continued uncertainty in the United Kingdom regarding the ratification of the Withdrawal Agreement – as agreed with the UK government in November 2018 – and the overall domestic political situation , a ‘ no-deal scenario ‘ on 1 November 2019 very much remains a possible outcome.

Since December 2017, the European Commission has been preparing for a 'no-deal scenario' . To date , the European Commission has tabled 19 legislative proposals. Political agreement has been reached on the remaining proposal – the contingency Regulation on the EU budget for 2019 -, which is expected to be formally adopted later this month.

The European Commission has concluded that there is non eed to amend any measures on substance and that they remain fit for purpose. The Commission does not plan any new measures ahead of the new withdrawal date.

A 'NO-DEAL' SCENARIO

In a 'no-deal' scenario, the UK will become a third country without any transitional arrangements. All EU primary and secondary law will cease to apply to the UK from that moment onwards. There will be no transition period, as provided for in the Withdrawal Agreement. This will obviously cause significant disruption for businesses and would have a serious negative impact.

In case of a 'no-deal scenario', the UK would be expected to adress three main separation issues as a precondition before the European Union would consider embarking on discussions about the future relationship.

These are:

1. Protecting and upholding the rights of citizens who have used their right to free movement before Brexit, 2. Honouring the financial obligations the UK has made as a Member State and, 3. Preserving the letter and spirit of the Good Friday Agreement and peace on the island of Ireland, as well as the integrity of the internal market.

CUSTOMS , INDIRECT TAXATION AND BORDER INSPECTION POSTS

In the field of customs and indirect taxation, the European Commission has published guidance notes on customs, value –added tax (VAT) and excise.

In the field of sanitary and phytosanitary controls, EU 27 Member States have set up new Border Inspection Posts or extending existing ones at entry points of imports from the UK into the European Union.

For more information, please see the:

-European Commission preparedness website on: https://ec.europa.eu/info/brexit/brexit-preparedness_en

-Member States national 'no-deal' websites on: https://ec.europa.eu/info/brexit-preparedness/national-brexit-information-member-states_en

EUROPEAN COMMISSION RELEASES DETAILED INFORMATION ON REQUIREMENTS FOR EU GOODS EXPORTED TO THE UNITED KINGDOM IN CASE OF HARD BREXIT

The European Commission has included in its Market Acess Database detailed information on the rules that the United Kingdom would apply on its imports from the European Union in case of a hard Brexit.

This publication should help businesses to be prepared in case the United Kingdom leaves the European Union without a negotiated deal.

The Market Acess Database provides detailed infromation on duties and taxes that apply to exports to a given country, as well as on import procedures and formalities that must be accomplished for customs clearance.

The Market Acess Database is available on: http://madb.europa.eu/madb/indexPubli.htm

In the context of a possible 'no deal' scenario the European Commission has also published 90 preparedness notices, 3 Commission communications, and has made 19 legislative proposals.

In this respect the Commission has published last week also:

- a series of reader-friendly factsheets on a 'no-deal' Brexit in all EU languages available on: https://ec.europa.eu/info/publications/factsheets-and-questions-and-answers_en

All further detailed information related to the European Commission's Contingency and Preparedness work is available on: https://ec.europa.eu/info/brexit/brexit-preparedness_en

EUROPEAN UNION COMPLETES PREPARATIONS FOR POSSIBLE NO DEAL SCENARIO ON 12 APRIL 2019

As it is increasingly likely that the United Kingdom will leave the European Union without a deal on 12 April, the European Commission has last week 25 March completed its 'no-deal' preparations.

At the same time the European Commission continues supporting the administrations in the EU Member states (EU 27) in their own preparations and urges businesses to continue informing themselves about the consequences of a possible 'no-deal' scenario and to complete their no-deal preparedness.

This follows the European Council (Article 50) conclusions last week calling for work to be continued on preparedness and contingency.

In the context of a possible 'no deal'scenario the European Commission has published 90 preparedness notices, 3 Commission communications, and has made 19 legislative proposals.

In this respect the Commission has published last week:

- a press release

- a series of reader-friendly factsheets on a 'no-deal' Brexit in all EU languages

available on: https://ec.europa.eu/info/publications/factsheets-and-questions-and-answers_en

All further detailed information related to the European Commission's Contingency and Preparedness work is available on: https://ec.europa.eu/info/brexit/brexit-preparedness_en

STATUS ON MARCH 25 OF TALKS REGARDING BREXIT BETWEEN UNITED KINGDOM AND EUROPEAN UNION

Last week on March 21 during the EU Council summit (EU 27 Prime ministers) in Brussels the European Union has given the United Kingdom different options on brexit.

The following different options still open:

- accept the 'Withdrawal Agreement' (deal scenario).

- leave the European Union without a deal (no deal scenario).

- remain within the European Union for a long period (extension of the Article 50 period).

- revoke the Article 50 exit process completely.

At the aforementioned summit in Brussels last Thursday, the European Union (EU 27) leaders decided that if the 'Withdrawal Agreement' should be swiftly (at the latest on April 12) approved by the UK Parliament, the UK's previously scheduled March 29 exit date would be delayed until May 22.

But if the UK Parliament do not agree the 'Withdrawal Agreement', UK will have only until April 12 to choose between the remaining alternatives.

"Until that date, all options will remain open" said Donald Tusk, the European Council President.

FURTHER INFORMATION ON BREXIT

All detailed information related to the European Commission's Contingency and Preparedness work is available on: https://ec.europa.eu/info/brexit/brexit-preparedness_en

ADOPTION BY EUROPEAN PARLIAMENT OF SEVERAL NO DEAL CONTINGENCY MEASURES

On 14 March 2019 the European Parliament has adopted a number of 'no-deal' contingency measures.

This will help ensure that the European Union is ready for a 'no-deal' scenario on 29 March.

The proposals adopted include: ensuring for a limited period basic air, road and rail connectivity in a 'no –deal' scenario, as well as allowing for continued reciprocal fishing access for EU and UK fisheries until the end of 2019 and for the provision of compensation to fishermen and operators in such a scenario.

Other proposals adopted include the continuation of the PEACE programme on the Island of Ireland until the end of 2020, as well as protecting the rights of Erasmus + participants in the event of a 'no-deal' scenario, and certain social security entitlements of those people who exercised their right to free movement before the UK ’s withdrawal.

Technical measures on ship inspections and the re-alignment Norht Sea –Mediterranean Core Network Corridor were also adopted. Further details of all contingency plans are available on the website mentioned below.

To date, the European Commission has tabled 19 legislative proposals. 17 proposals have been adopted or agreed by the Parliament and the Council. Formal adoption of all those files by the Council (Ministers of EU member States) will take place shortly. Two proposals are still pending.

These proposals are temporary in nature, limited in scope and will be adopted unilaterally by the European Union. They are not 'mini-deals' and have not been negotiated with the UK.

In addition to this legislative work, the European Commission has also published 88 preparedness notices, along with 3 detailed Brexit Preparedness Communications.

All information related to the European Commission’s ongoing contingency and preparedness work is available on: https://ec.europa.eu/info/brexit/brexit-preparedness_en

BREXIT PREPAREDNESS - POLITICAL AGREEMENT ON CONTINGENCY MEASURES FOR BASIC ROAD TRANSPORT

More information can be found here >

EUROPEAN COMMISSION INTENSIFIES NO DEAL CUSTOMS PREPAREDNESS OUTREACH TO EU BUSINESSES

Last week the European Commission has stepped up its 'no-deal' outreach to EU businesses in the area of customs and indirect taxation such as VAT, given the risk that the United Kingdom may leave the European Union on 30 March 2019 without a deal ('no-deal' scenario).

The outreach campaign launched last week is part of the European Commission's ongoing efforts to prepare for the UK's exit of the European Union without a deal, in line with the European Council conclusions of December 2018, calling for intensified preparedness work for all scenarios. Preparing for the UK becoming a non–EU country is of highest importance if significant disruption for EU business is to be avoided.

Last week’s launch aims to raise awareness amongst the EU’s businesses. In order to prepare for a 'no –deal' scenario and to continue trading with the UK, these businesses should:

- ASSESS whether they have the neccessary technical capacity to deal with customs procedures and rules, e.g. on 'Preferential rules of origin'.

- CONSIDER obtaining various customs authorisations and registrations in order to facilitate their trading activity if the UK is part of their supply chain.

In this respect a range of material (see website on https://ec.europa.eu/taxation_customs/uk_withdrawal_en

) is available to businesses. Preparatory work, supported by the European Commission, is also underway in Member States to ensure that national customs infrastructure and logistics are ready to deal with no-deal scenario.

For more information in this respect, please see the European Commission’s Brexit Preparedness website including 'Brexit preparedness notices' on: https://ec.europa.eu/info/brexit/brexit-preparedness_en

EUROPEAN COMMISSION ADOPTS NO –DEAL CONTINGENCY MEASURE FOR RAILWAY AND CONNECTIVITY

Given the increasing risk that the United Kingdom may leave the European Union on 30 March 2019 without a deal, the European Commission has last week on 12 February 2019 adopted a proposal (see attachment) to help mitigate the significant impact that such a scenario would have on rail transport and connectivity between the EU and the UK.

The proposal (see attachement) will ensure the validity of safety authorisations for certain parts of rail infrastructure for a strictly limited period of three months to allow long-term solutions in line with EU law to be put in place.

For more information concerning the current status of the aforementioned legislative measures and preparedness notices, please see the European Commission’s Brexit preparedness website on: https://ec.europa.eu/info/brexit/brexit-preparedness _fr

More information can be found here >

NEW VERSION OF EUROPEAN UNION CUSTOMS DATA MODEL GOES LIVE

As of February 8, 2019 a new version of the European Union Customs Data Model (EUCDM) web-publication went live and accessible for businesses.

The new version (EUCDM 3.0) reflects all the recent changes in the customs legislation which affects the data requirements.

By using the web-publication of the EUCDM all interested parties can see the legal provisions of the Union Customs Code Delegated Act (UCC DA) and the Union Customs Code Implementing Act (UCC IA) in a structured way, facilitating the use of information.

For more detailed information in this respect, please have a look on https://svn.taxud.gefeg.com/svn/Documentation/EUCDM/EN/index.htm

SLIDES UK BREXIT ROLL ON ROLL OF PROCESS FOR GOODS ENTERING OF LEAVING THE UK

Click here to read the whole document >

EUROPEAN COMMISSION BEGINS PROCEDURE FOR THE SIGNATURE AND CONCLUSION OF THE AGREEMENT ON THE UK’S WITHDRAWAL FROM THE EUROPEAN UNION

Following the endorsement by the European Council (Article 50) on 25 November 2018 of the draft withdrawal Agreement - as completed at negotiator level on 14 November 2018 –the European Commission has last week on 5 December 2018 adopted two proposals for council decisions on the signature and conclusion of the text.

These proposals launch the formal process necessary for the European Union to conclude the Withdrawal Agreement and follow the European Council (Article 50 ) conclusions, which invited the European Commission to "take the necessary steps to ensure that the agreement can enter inot force on 30 March 2019, so as to provide for an orderly withdrawal".

The EU Council must now authorise the signature of the Withdrawal Agreement on behalf of the European Union.

The European Parliament must then give its consent before being concluded by the Council.

To enter into Force, the Withdrawal Agreement will, of course, also have to be ratified by the United Kingdom, in accordance with its own constitutional requirements.

For more detailed information concerning the content of the afore-mentioned proposals - please see on: https://ec.europa.eu/commission/sites/beta-political/files/proposal_for_a_council_decision_on_the_conclusion_of_the_wa_.pdf

PUBLICATION OF THE NEW VERSION OF THE COMBINED NOMENCLATURE APPLICABLE AS FROM 1 JANUARY 2019

The European Commission has published the new version of the Combined Nomenclature Codes (CN codes) applicable as from 1 January 2019.

The Combined Nomenclature (CN) : - forms the basis for the declaration of goods at importation and exportation or when subject to intra-Community trade statistics. - determines which rate of customs duty applies for goods imported in the European Union and how the goods are treated for statistical purposes.

The Combined Nomenclature is thus a vital working tool for business and is updated every year.

The new version is now available as Commission Implementing Regulation (EU) Nr 2018/1602 of 31 October 2018 published in the Official Journal of the European Union N° L 273 of 31 October 2018.

The concerned Offical Journal Nr L 273 is available via the European website EUR-LEX on http://eur-lex.europa.eu

NEW LIST OF PRODUCTS CONCERNING COMMUNITY REGIME FOR THE CONTROL OF EXPORTS, TRANSFER, BROKERING AND TRANSIT OF DUAL-USE ITEMS

Click here to read the whole document >

ADOPTION BY EUROPEAN COMMISSION OF MEASURES TO PROTECT INTELLECTUAL PROPERTY RIGHTS

With the current initiatives, the European Commission aims to:

* Ensure an equally high level of legal protection and a predictable judicial framework across the European Union. New guidance provides clarification on how to apply the 2004 Directive on the enforcement of intellectual property rights . The Directive has proved a relevant tool in figthing intellectual property rights abuse , but there have been differing interpretations among Member States of someof its provisions over the years. The new guidance clarifies these interpretation issues, which will increase legal certainty for all stakeholders and facilitate civil enforcement across the EU straight away, without the need for new legislation.

*Encourage industry to fight IP infringements. Building on the positive experiences under the Memorandum of Understanding on the sale of counterfeitgoods via the internet, the European Commission continues to support industry-led initiatives to combat IP infringements, including voluntary agreements on advertising on websites, on payment services and on transport and shipping. Such agreements can lead to faster action against counterfeiting and piracy than court actions.

*Reduce the volume of counterfeited products reaching the EU market. The European Commission proposes to reinforce cooperation programmes with third countries (China, South-East Asia, Latin America) and create a list of markets that are reported to engage in, or facilitate, substantial IPR infringement. The European Commission will publish an updated report on IPR enforcement in third countries.

- Creating a fair and balanced system for Standard Essential Patents: Many key technologies that are part of global industry standards (such as WiFi or 4G) are protected by Standard Essential Patents (SEPs). The European Commission has published guidance and recommendations for a balanced and efficiënt SEPs system where two objectives are reconciled: product manufacturers can access technologies under transparent licensing rules and at the same time patent-holders are rewarded for their investments in R&D and standardisation activities so that they are incentivised to offer their best technologies for inclusion in standards.Click here to read the whole document >

OVERVIEW OF FREE TRADE ASSSOCIATIONS AND OTHER TRADE NEGOTIATIONS

Click here to read the whole document >

PUBLICATION OF THE NEW VERSION OF THE COMBINED NOMENCLATURE APPLICABLE AS FROM 1 JANUARY 2018

The European Commission has published the new version of the Combined Nomenclature (customs codes) applicable as from 1 January 2018.

The Combined Nomenclature (CN): - forms the basis for the declaration of goods at importation and exportation or when subject to intra-Community trade statistics. - determines which rate of customs duty applies for goods imported in the European Union and how the goods are treated for statistical purposes.

The Combined Nomenclature is thus a vital working tool for business and is updated every year.

The new version is now available as Commission Implementing Regulation (EU) Nº 2017/1925 of 12 October 2017 published in the Official Journal of the European Union Nº L 282 of 31 October 2017.

The concerned Offical Journal Nº L 282 is available via the European website EUR-LEX on http://eur-lex.europa.eu

OVERVIEW DUTY SUSPENSION AND QUOTA REQUESTS PER 1 JULY 2017

Enclosed the list including all new requests and amendments for tariff suspensions and quota for 1.7.2017.

The latest state of affairs with regard to these request (changes and objections) you can find on the website of the European Commission: Suspensions and Quota

These requests will be discussed from November till January in the Economic Tariff Questions Group (ETQG) with the European Commission and the EU member states.

If there are no objections these requests will get into force as from 1 July 2017.

If you are producing (in the EU) one of the products mentioned on the list, a tariff suspension could have a negative impact on your business. In that case you can file an objection to these requests . You need to file this objection at least 9 December 2016 .

Objections against running suspensions and quota need to be filed before 7 November 2016.

The next deadline for filing new requests is 1 February 2017.

STATUS NEW FREE TRADE AGREEMENT BETWEEN EUROPEAN UNION AND MERCOSUR

The European Union is currently negotiating a new trade agreement with Mercosur as part of the overall negotiation for a bi-regional Association Agreement which also cover a political and a cooperation pillar. Mercosur was established in 1991 and encompasses Argentina , Brazil , Paraguay , Uruguay ,Venezuela and Bolivia.

In 1995 , the European Union and Mercosur signed an Inter-regional Framework Cooperation Agreement (see attachment) , including cooperation on trade-related matters. This agreement was concluded in 1999 .

The negotiations for the new Free Trade Agreement with Mercosur were relaunched at the EU- Mercosur summit in Madrid on 17 May 2010 .

The objective is to negotiate a comprehensive trade agreement , covering not only trade in industrial and agricultural goods but also services and establishment and government procurement , and the improvement of rules inter alia on government procurement , intellectual property , customs and trade facilitation and technical barriers tot trade.

Ten negotiation rounds have taken place since the start on 17 May 2010 . The 10 th negotiating round took place in Brussels on 10 -14 October 2016 .This was the first negotiation round since 2012 and the first to be held since the exchange of market access offers of 11 May 2016.

The EU and the Mercosur negotiators discussed the full range of negotiating texts and rules .They also exchanged views on how to progress on market access issues.

Both sides agreed on further intersessional work on a series of issues and on holding the next round of negotiations in the month of March 2017.

EUROPEAN COMMISSION PUBLISHES 2016 VERSION OF THE MULTIANNUAL STRATEGIC PLAN

The European Commission has published the 2016 version of the Multiannual Strategic Plan

The whole plan can be consulted here...

PUBLICATION OF NEW EU REGULATIONS REGARDING TARIFF SUSPENSIONS AND TARIFF QUOTAS APPLICABLE FROM 1 JULY 2016

1. COUNCIL REGULATION (EU) No 2016/1051 of 24 June 2016 amending Regulation (EU) No 1387/2013 suspending the autonomous Common Customs Tariff duties on certain agricultural and industrial products

Published on 30 June 2016 in the Official Journal of the European Union L173 and applies from 1 July 2016

2. COUNCIL REGULATION (EU) No 2016/1050 of 24 June 2016 amending Regulation (EU) No 1388/2013 opening and providing for the management of autonomous tariff quotas of the Union for certain agricultural and industrial products.

Published on 30 June 2016 in the Official Journal of the European Union L 345 and applies from 1 July 2016

The next deadline to apply for new tariff suspensions, tariff quotas or amendments is 1 July 2016 (for suspensions and quotas that apply from 1 July 2017).

NEW UNION CUSTOMS CODE IN FORCE ON 1 MAY 2016

The new customs rules that came into force yesterday 1 May 2016 will have an important impact for businesses that trade in Europe.

The new Union Customs Code (UCC) represents a major overhaul of existing EU customs legislation , which dates back to 1992.

The Union Customs Code is the new framework regulation for the rules and procedures for customs throughout the European Union.

It reflects a move forward towards a more modern customs environment for EU Member States. More specifically , it will:

-streamline customs legislation and procedures across the European Union;

-offer greater legal certainty and uniformity to businesses and increase clarity for customs officials;

-simply customs rules and procedures to make customs transactions more efficient and modern;

-complete the shift to a paperless and fully electronic customs environment;

-introduce more speedy customs procedures for compliant business.

The Union Customs Code (UCC) will be fully implemented by the end of 2020. During the transitional period , the new rules will apply by using existing IT systems and, in some cases, paper forms.

All information with respect to the new UCC Legislation, the UCC Work Program, Guidance documents is available on http://ec.europa.eu/taxation_customs/customs/customs_code/union_customs_code/ucc/index_en.htm.

PUBLICATION OF UPDATED AUTHORISED ECONOMIC OPERATOR GUIDELINES APPLICABLE AS FROM 1 MAY 2016

FIRST MODULE OF THE EU ELEARNING PROGRAMME ON THE UNION CUSTOMS CODE IS AVAILABLE

ENTRY INTO FORCE OF EUROPEAN UNION CONTROL LIST OF DUAL USE ITEMS

INFORMATION NOTE REGARDING THE UNION CUSTOMS CODE

The information note regarding the Union Customs Code has been published and can be consulted here:

consult the document in Dutch...

consult the document in French...

PUBLICATION BY BELGIAN CUSTOMS ADMINISTRATION OF STRATEGIC PLAN 2015 - 2019

The Belgian Customs Administration have published the Strategic Plan for 2015-2019.

PUBLICATION OF NEW EXPLANATORY NOTES TO THE COMBINED NOMENCLATURE OF THE EUROPEAN UNION

The 2015 version of the Explanatory Notes to the Combined Nomenclature has been published in the Official Journal of the European Union No C 76 of 4 March 2015.

The explanatory notes are considered to be an important instrument for interpreting the scope of the various Tariff Headings.

These explanatory Notes are available on http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:C:2015:076:FULL&from=EN.

PUBLICATION BY EUROPEAN COMMISSION OF THE 2015 VERSION OF THE COMBINED NOMENCLATURE

The European Commission publishes the 2015 version of the Combined Nomenclature.

The Combined Nomenclature :

- forms the basis for the declaration of goods at importation and exportation or when subject to intra-Community trade statistics .

- determines which rate of customs duty applies and how the goods are treated for statistical purposes.

The Combined Nomenclature is thus a vital working tool for business and the EU Member States' Customs administrations and is updated every year.

The new version is now available as Commission Implementing Regulation (EU) N 1101 /2014 of 16 October 2014 published in the Official Journal of the European Union N L 312 of 31 October 2014 . The aforementioned Offical Journal N L 312 is available on the European website http://eur-lex.europa.eu).

As soon as possible we will provide you with conversion tables in order to facilitate the work for business to translate the current CN codes to the new CN codes.

The new version of the Combined Nomenclature applies from 1 January 2015.

PUBLICATION BY EUROPEAN COMMISSION OF THE 2014 VERSION OF THE COMBINED NOMENCLATURE

The European Commission has published the new version of the Combined Nomenclature (CN) applicable from 1 January 2014 .

The Combined Nomenclature forms the basis for the declaration of goods at importation and exportation or when subject to intra-Community trade statistics . This determines which rate of customs duty applies and how the goods are treated for statistical purposes.

The Combined Nomenclature is thus a vital working tool for business and the EU member states ' Customs administrations.

The Combined Nomenclature was established by Council Regulation (EEC) Nº 2658/87 on the Tariff and statistical nomenclature and on the Common Customs tariff and is updated every year .

The latest version is now available as Commission Implementing Regulation (EU) Nº 1001 /2013 of 4 October 2013 published in the Official Journal of the European Union Nº L 290 of 31 October 2013 . ( Offical Journal available on the European website http://eur-lex.europa.eu).

As soon as possible we will provide you with conversion tables in order to facilitate the work for business to translate the current CN codes to the new CN codes.

The new version of the Combined Nomenclature applies from 1 January 2014.

GUIDELINES SASP

Click here to read the whole document

COUNCIL RESOLUTION ON EU CUSTOMS ACTION PLAN TO COMBAT IPR INFRINGEMENTS FOR THE YEARS 2013-2017

Click here to read the whole document >

EU -US MUTUAL RECOGNITION DECISION

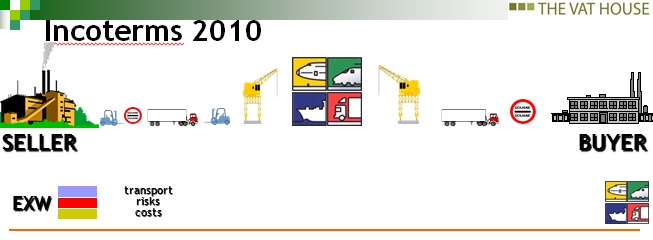

ANALYIS INCOTERMS 2010

EUROPEAN COMMISSION PUBLISHES THE 2013 VERSION OF THE COMBINED NOMENCLATURE

The European Commission has published the new version of the Combined Nomenclature (CN) applicable from 1 January 2013 .

The Combined Nomenclature forms the basis for the declaration of goods at importation and exportation or when subject to intra-Community trade statistics . This determines which rate of customs duty applies and how the goods are treated for statistical purposes.

The Combined Nomenclature is thus a vital working tool for business and the EU member states ‘ Customs administrations.

The Combined Nomenclature was established by Council Regulation (EEC) Nº 2658/87 on the Tariff and statistical nomenclature and on the Common Customs tariff and is updated every year .

The latest version is now available as Commission Regulation (EU) Nº 927/2012 published in the Official Journal of the European Union Nº L 304 of 31 October 2012 . ( Offical Journal available on the European website http://eur-lex.europa.eu).

As soon as possible we will provide you with conversion tables in order to facilitate the work for business to

translate the current CN codes to the new CN codes.

The new version of the Combined Nomenclature applies from 1 January 2013.

INFORMATION ON COMMISSION PROPOSAL FOR UNION CUSTOMS CODE

Click here to open the slideshow about information on commission proposal for union customs code

Click here to open the slideshow about information on commission proposal for union customs code

Customs: EU and USA agree to recognise each other's "trusted traders"

Brussels, 04 May 2012 − EU and U.S. certified trusted traders will enjoy lower costs, simplified procedures and greater predictability in their transatlantic activities, as a result of a mutual recognition decision signed today. The European Union and the United States of America formally agreed to recognise each other's safe traders, thereby allowing these companies to benefit from faster controls and reduced administration for customs clearance. Importantly, mutual recognition will also improve security on imports and exports, by enabling customs authorities to focus their attention on real risk areas.

Brussels, 04 May 2012 − EU and U.S. certified trusted traders will enjoy lower costs, simplified procedures and greater predictability in their transatlantic activities, as a result of a mutual recognition decision signed today. The European Union and the United States of America formally agreed to recognise each other's safe traders, thereby allowing these companies to benefit from faster controls and reduced administration for customs clearance. Importantly, mutual recognition will also improve security on imports and exports, by enabling customs authorities to focus their attention on real risk areas.

There are currently some five thousand companies approved as Authorised Economic Operators (AEOs) in the EU - a number which is growing year on year. The EU and USA are strategic trade partners, with imports and exports accounting for almost €500 billion in 2011. Today's decision will further boost trade opportunities and contribute to the smooth flow of goods between both sides, without compromising the high security standards on either side of the Atlantic. The joint decision will start to be implemented from 1 July 2012.

Commissioner Semeta said: "Today's agreement is a major step forward in the EU-US trade relationship. At a time when businesses need all the support they can get, this will make life easier and cheaper for many transatlantic traders. It will also help to ensure that security checks on traded goods are more focussed and effective, further improving the protection that customs provides for each and every citizen."

Under this agreement the EU and the U.S. will recognise each other's security certified operators. Authorised economic operators in the EU will receive benefits when exporting to the US market, and the EU will reciprocate for certified members of the US Customs-Trade Partnership against terrorism (C-TPAT).

Mutual recognition of trade partnership programs prevents the proliferation of incompatible standards, and promotes harmonisation of customs practices and procedures worldwide.

Background

Global trade has soared in the past decade and the chain of transport and logistics system for the world's cargo is becoming increasingly complex. This has forced customs administrations to improve their tools for managing the international movement of goods to better respond to threats related to security, safety and fraud.

Since 2008 European companies can apply for an AEO status to have easier access to customs simplifications and to be in a more favourable position to comply with EU security requirements. The AEO status at EU level identifies safe and reliable businesses that are engaged in international trade. This means they deliver high standards of security and compliance, therefore making these companies highly trusted trade partners at customs checks. Fewer inspections on goods are necessary and formal customs procedures are quicker to fill in. This benefits the companies because the goods can move faster from one destination to another and help to lower transport costs. It also benefits EU customs administrations to concentrate their efforts on checking high risk transactions.

Mutual Recognition of respective trade partnerships is a very important step towards improving the protection of citizens against terrorist attacks. At the same time, recognising each other as "reliable traders" will also lead to more effective container inspection and important cost saving for companies, in particular SMEs.

The EU wants its major trade partners across the globe to recognise the AEO status to facilitate and protect international trade even more in the future. Switzerland, Norway and Japan mutually recognise the EU's certification. A similar agreement is also being explored with China.

The Transatlantic Economic Council (TEC) has offered important political support to achieving EU-US mutual recognition. At its November 2011 meeting a break-through was achieved when the Commission and US Department of Homeland Security announced the completion of preparatory work on Mutual Recognition. The Transatlantic Economic Council (TEC) is the central political platform for EU-U.S. cooperation on a wide range of high profile regulatory and strategic issues, with a view to furthering trade and investment and, ultimately, growth and jobs.

SUMMARY REPORT WITH OUTCOME OF PUBLIC CONSULTATION ON GREEN PAPER ON THE FUTURE OF VAT

With the adoption on 1 December 2010 of the Green paper on the future of VAT the European Commission launched a consultation process open to every stakeholder on an evaluation of all elements of the current VAT system as well as possible ways to strengthen its coherence with the single market and its capacity as a revenue raiser whilst reducing the cost of compliance.

On the basis of the 33 questions in the Green Paper , the public consultation gave stakeholders an opportunity to share their experience of the current VAT system and express their views on the future of VAT.

The consultation ended on 31 May 2011 .

Click here to find the document

NEW PROPOSAL FOR A CUSTOMS AND TAX ACTION PROGRAMME IN THE EUROPEAN UNION (FISCUS)

In order to build on the EU 's taxation and customs work and be fully equipped to meet future challenges in these fields , the European Commission on 9 November 2011 adaopted a proposal for the FICUS programme.

FISCUS is the new financing programme covering EU customs and taxation for the period 2014-2020 , as foreseen within the Multi-Annual Financial Framework proposal adopted by the European Commission in June 2011.

This programme is the successor of the current Fiscalis 2013 and Customs 2013 programmes. It will support cooperation between the customs and tax authorities and other parties through networking and knowledge-sharing ,and by funding state of the art I.T. infrastructure and systems.

In the current economic situation , this programme will deliver real benefits to public finances by improving the ability of Member states and the EU to collect revenu and fight fraud. It will also help Member States to cut costs, particularly by sharing I.T. development .

Finaly , this is a growth -promoting programme : it will facilitate trade , improve the functioning of the Internal Market and promote pro-growth tax reforms .

The budget for the programme for the 7 year period (2014 -2020) is EUR 777,6 million. This will be allocated through annual work programmes drawn up by the European Commission each year , on the basis of the priorities identified.

The principle objective of FISCUS is to support the Customs Union and strengthen the Internal Market by improving cooperation and coordination in taxation policies.

The Regulation also outlines specific objectives aimed at meeting the challenges in taxation and customs in the yers ahead . These include:

-Supporting the application and implementation of EU law in both areas

-Improving the capacities of tax and customs administrations

-Reducing administrative burdens

- Ensuring the safety and security of EU citizens

-Tackling fraud and tax evasion

-Facilitating trade and cooperating with trading partners

-Protect the EU 's and Member State 's fiancial interests.

Click here to find enclosed the workingdocument from the European Commission with a summary of the principal issues of the concerned proposal.

COMMISSION PUBLISHES THE 2012 VERSION OF THE COMBINED NOMENCLATURE

The European Commission has published the latest version of the Combined Nomenclature (CN) applicable from 1 January 2012 .

The European Commission has published the latest version of the Combined Nomenclature (CN) applicable from 1 January 2012 .

The Combined Nomenclature forms the basis for the declaration of goods at importation and exportation or when subject to intra'Community trade statistics . This determines which rate of customs duty applies and how the goods are treated for statistical purposes.

The Combined Nomenclature is thus a vital working tool for business and the EU member states ' Customs administrations.

The Combined Nomenclature was established by Council Regulation (EEC) N° 2658/87 on the Tariff and statistical nomenclature and on the Common Customs tariff and is updated every year .

The latest version is now available as Commission Regulation (EU) N° 1006/2011 published in the Official Journal of the European Union N° L 282 of 28 October 2011 . ( Offical Journal available on the European website EUR LEX).

As soon as possible we will provide you with conversion tables in order to faciiltate the work for business to

translate the current CN codes to the new CN codes.

The new version of the Combined Nomenclature applies from 1 January 2012.

NIEUWE FACILITEITEN VOOR AEO-GECERTIFICEERDE BEDRIJVEN

NIEUWE FACILITEITEN VOOR AEO-GECERTIFICEERDE BEDRIJVEN

AEO-gecertificeerde bedrijven kunnen voortaan vermindering of vrijstelling van zekerheidstelling bekomen voor de diverse douaneregelingen en faciliteiten genieten bij aanvraag en toepassing van vereenvoudigde procedures bij invoer en uitvoer van goederen

Geachte mevrouw,

Geachte heer,

Ondernemingen die te maken hebben met douaneprocedures bij in- of uitvoer van goederen het statuut verkrijgen inzake "Geautoriseerde marktdeelnemer" (AEO).

Bij de opbouw van het aanvraagdossier inzake AEO dient rekening te worden gehouden met de rol van het bedrijf in de toeleveringsketen en met specifieke voorwaarden inzake vorm en inhoud waaraan dit dossier dient te voldoen.

Zo dient bij het aanvraagdossier een uitgebreide " self-assessment" vragenlijst te worden ingevuld op basis de vereiste onderliggende bewijsvoering.

Voor bepaalde bedrijven, actief in de logistieke sector (expediteurs, scheepsagenten en vervoerders) heeft de douaneadministratie vragenlijsten opgesteld die eenvoudiger zijn en op maat zijn van de firma's, actief in de voornoemde sector, waardoor de procedures voor het verkrijgen van het AEO Statuut voor die bedrijven minder zwaar zijn geworden.

Op 18 mei 2010 werden door de administratie der douane en accijnzen nieuwe richtlijnen gepubliceerd op basis waarvan aan AEO-gecertificeerde bedrijven vermindering of vrijstelling van borg kan worden verleend.

Bovendien staat vast dat op korte termijn diverse bijkomende faciliteiten inzake goederencontroles zullen worden verbonden ten overstaan van goederenstromen waarbij de verschillende economische actoren die tussenkomen bij de goederenbehandeling AEO-gecertificeerd zullen moeten zijn. Om die reden zal de druk toenemen om AEO-gecertificeerd te worden bij alle bedrijven die een schakel vormen in de logisitieke keten.

De ervaring leert mij dat industriële bedrijven (importeurs en exporteurs) die nu reeds AEO-gecertificeerd zijn ervoor kiezen om op termijn alleen nog samen te werken met logistieke dienstverleners en douane-expediteurs die eveneens het AEO statuut zullen hebben.

Ook in het kader van de toepassing van het "gemoderniseerd douanewetboek" dat medio 2013 in werking zal treden wordt het duidelijk dat in de toekomst alleen nog faciliteiten op het vlak van douanecontroles en vereenvoudigde procedures bij in -en uitvoer van goederen zullen verleend worden aan ondernemingen die het AEO-statuut bezitten.

Bovendien wordt het "herbeoordelingsproces" ( nieuwe audit) door de douaneautoriteiten welke alle - niet AEO gecertificeerde bedrijven - die het statuut hebben van "toegelaten afzender/exporteur " en "toegelaten geadresseerde " moeten doorlopen gebaseerd op de hogergenoemde "self-assessment " vragenlijst .

Omwille van de diverse hiervoor uiteengezette factoren ben ik van oordeel dat het thans het juiste ogenblik is om een aanvraagprocedure voor de erkenning als AEO gecertificeerd bedrijf te starten teneinde in de toekomst nog een volwaardige rol te kunnen spelen bij de behandeling (als douane-expediteur, vervoerder , opslagbedrijf , invoerder , uitvoerder ,..) van goederenstromen in de internationale logistieke keten .

MIJN DIENSTVERLENING

Als douanespecialist met meer dan 30 jaar ervaring en in mijn hoedanigheid van Voorzitter van het Douaneplatform volg ik de ontwikkelingen van het AEO project in Belgie en in de diverse lidstaten van de Europese Unie zeer nauwgezet op en overleg hieromtrent zeer frekwent met de verantwoordelijken in Belgie en in de diverse EU lidstaten. In dit verband heb ik de voorbije maanden zoals in Belgie als in andere EU lidstaten met mijn medewerkers diverse AEO dossiers afgehandeld.

Vanuit die kennis opbouw kan ik u dan ook optimaal adviseren omtrent het nut van een AEO aanvraag en optimaal begeleiden bij het volledige proces voor een aanvraagdossier inzake AEO

In dit verband verzorg ik eveneens doelgerichte "in-company" opleidingen.

Indien U meer informatie hieromtrent wenst kan u met ondergetekende contact opnemen op onderstaand e-mailadres:

freddy.pirron@skynet.be of eventueel op GSM nummer 0475 92 91 44.

Ik vertrouw er op U hiermee van dienst te zijn geweest.

Met vriendelijke groeten,

Freddy Pirron

Zaakvoerder Consultingbedrijf Freddy Pirron

Voorzitter Douaneplatform

NEW CONSOLIDATED PRELIMINARY DRAFT OF THE MODERNISED CUSTOMS CODE IMPLEMENTING PROVISIONS